Pamela Rodriguez is actually an official Financial Planner, Collection eight and you can 66 license manager, having ten years of experience when you look loans for bad credit on disability at the Economic Considered and Old-age Considered. She actually is the fresh founder and you will Ceo of Satisfied Earnings LLC, the latest Societal Cover Speaker for AARP, additionally the Treasurer towards the Economic Planning Relationship out of NorCal.

Do the debt from your own college days see daunting? You are not by yourself: Student loans regarding the You.S. full more $step 1.six trillion. That is second merely to how big is the country’s financial financial obligation.

Ironically, the responsibility away from figuratively speaking is therefore it is more difficult to possess college graduates buying a property. People in politics is debating what to do about the situation, however in new interim, individual Us citizens cannot hold out so that they can work it away.

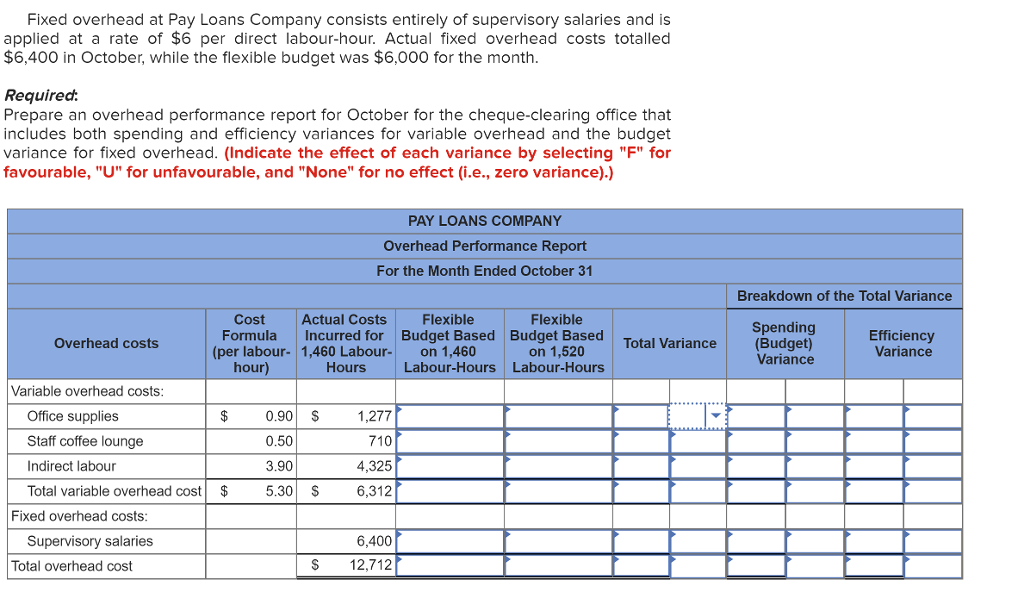

Development a want to control your college loans is crucial in order to your enough time-term monetary wellness. We mention 10 steps to obtain handle.

Key Takeaways

- Developing a plan to control your college loans is critical so you’re able to your much time-title financial health.

- Understand how far your debt, new regards to your loan deal(s), comment the newest elegance attacks, and you will consider merging your debt if it makes sense.

- Pay off the fresh new financing towards the higher rates of interest very first given that you deal with your debt.

- Paying down their prominent balance and spending your funds automatically is also help you reach your needs reduced.

- Mention alternative arrangements, deferment, and you may mortgage forgiveness (otherwise launch) so you’re able to in the act.

step 1. Estimate Their Overall Loans

As with any brand of obligations disease, to begin with you need to know is the overall count you borrowed from. People usually scholar having numerous fund, one another federally sponsored and personal, with developed for new financing annually these people were at school. So buckle down and you may perform some math. Only because of the knowing your total loans could you establish an idea to invest it down, combine they, or even talk about forgiveness.

dos. Be aware of the Conditions

Because you summarize the dimensions of the debt, in addition to itemize the regards to all of the mortgage. Each one could have some other rates of interest and various installment guidelines. You may need this info to cultivate a revenge plan one stops more desire, charge, and you may punishment.

The Service out-of Training offers an online funding, Federal Student Assistance, to simply help pupils see their utmost repayment agreements and would the financing.

step three. Comment the newest Elegance Attacks

As you pull along with her the newest specifics, so as to per loan features an elegance period. This is the period of time you’ve got just after graduation prior to you have got to start using their financing right back. These can including disagree. For example, Stafford money has actually a half a dozen-times sophistication months, when you find yourself Perkins funds make you 9 months before you need begin making payments.

To add financial relief from brand new COVID-19 pandemic, new You.S. regulators have frozen all of the money and you may desire to the federal figuratively speaking until .

4. Believe Consolidation

Once you’ve the facts, you can even go through the option of combining all the fund. The top and additionally out of consolidation would be the fact it usually reduces the weight of your own monthly premiums. it apparently lengthens the payoff months, that is a mixed true blessing. Remember, it could make you additional time to invest the debt, but it addittionally contributes so much more focus payments too.

Additionally, the rate for the consolidated financing is generally more than what you are using toward the your finance. Definitely contrast loan terms and conditions prior to signing upwards to own consolidation.

There is certainly that important factor you have to keep in mind. For folks who consolidate, your clean out your straight to the fresh new deferment solutions and you may earnings-oriented repayment plans which can be connected to some government money. We story any of these less than.