When it comes to funding your home, that proportions doesn’t fit all the. Although old-fashioned options eg finance, family security credit lines (HELOCS), refinancing, and you will opposite mortgages can perhaps work better for the majority property owners, the previous go up out of loan choice including household guarantee dealers and you may almost every other growing platforms have made it clear that there is an ever-increasing need for other options. Discover more about alternative how to get security from your domestic, to help you build a more advised decision.

Traditional Possibilities: Positives and negatives

Fund, HELOCs, refinancing, and you may contrary mortgages can all be glamorous ways to utilize the fresh new collateral you have collected of your property. Yet not, you will find often as many drawbacks as there are gurus – it is therefore vital that you understand the pros and cons each and every to know why particular homeowners seek resource options. See the graph below to quickly examine mortgage possibilities, upcoming keep reading for lots more information on each.

Domestic Collateral Loans

A property equity financing is one of the most prominent implies one to property owners accessibility its security. There are masters, as well as a foreseeable payment due to the loan’s repaired attract rates, therefore the simple fact that you’re getting the new security in a single swelling share fee. Hence, a property equity financing typically is practical if you are looking so you can safety the cost of a remodelling opportunity or highest you to-of costs. Together with, the interest money are taxation-deductible if you find yourself with the money getting renovations.

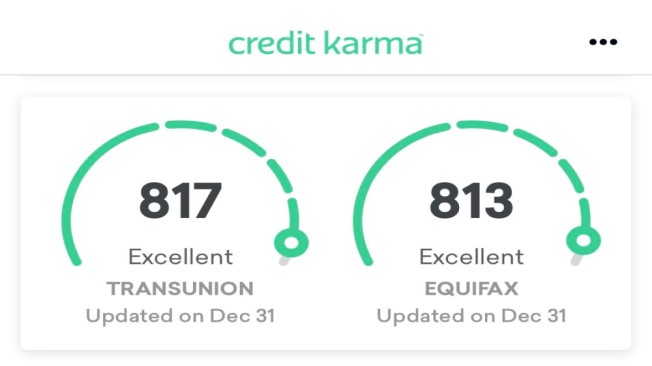

As to the reasons try to find a property guarantee loan choice? A number of causes: First, you will have to pay back the mortgage together with their regular home loan repayments. Assuming the borrowing are quicker-than-higher level (around 680), you will possibly not additionally be accepted for a home equity loan. Ultimately, the program process shall be invasive, troublesome, and you will taxing.

Household Equity Lines of credit (HELOC)

HELOCs, a common replacement for a home equity loan, render quick and easy access to fund should you you want them. Although you generally need at least credit history regarding 680 so you can qualify for a HELOC, it will in reality make it easier to improve your rating over the years. What’s more, you may be in a position to take pleasure in income tax masters – deductions around $a hundred,100000. Once the it is a credit line, there isn’t any attract due if you don’t sign up for currency, and remove to you desire up until you struck their limit.

However with it self-reliance appear the chance of even more obligations. For example, if you intend to use it to pay off handmade cards that have large interest rates, you might wind up racking up significantly more charge. Which in fact happen so often that it is recognized to loan providers because reloading .

Another big disadvantage that encourage homeowners to seek a HELOC choice ‘s the instability and you will unpredictability that comes in addition to this choice, due to the fact variability inside pricing may cause changing costs. The financial can also frost their HELOC at any time – otherwise decrease your credit limit – in case there are a decline on your credit rating otherwise home really worth.

Find out how well-known its to own property owners like you to apply to possess lenders and you may HELOCs, in our 2021 Citizen Statement.

Cash-out Refinance

One alternative to property guarantee mortgage was a cash-away re-finance. One of the primary perks out of a funds-out refinance is that you could safer a lower rate of interest in your mortgage, and thus lower monthly premiums and a lot more dollars to fund other expenses. Or, if you can create highest money, a refinance could be a good way to reduce your own mortgage.

Obviously, refinancing features its own group of challenges. While the you will be generally paying your current home loan with a new you to, you might be extending your home loan timeline and you are saddled with the same costs your handled to begin with: app, closure, and origination fees, term insurance coverage, and perhaps an appraisal.

Full, you’ll shell out anywhere between two and half a dozen per cent of your full matter your obtain, according to particular lender. But-called no-cost refinances might be inaccurate, just like the you will probably possess a higher level to compensate. In the event the matter you may be borrowing from the bank are more than 80% of the residence’s value, you will probably have to pay for private home loan insurance coverage (PMI) .

Clearing the newest hurdles regarding app and you will certification can lead to dry comes to an end for almost all residents who possess imperfections on their credit history otherwise whoever scores simply are not high enough; very lenders need a credit score of at least 620. These are simply some of the reasons home owners will see themselves trying a substitute for a profit-out re-finance.

Contrary Financial

And no monthly premiums, an opposing mortgage will be good for elderly home owners looking for more income throughout later years; a recently available imagine on the National Opposite Lenders Connection found you to definitely senior citizens got $eight.54 trillion tied within the a residential property equity. Yet not, you happen to be nevertheless accountable for the brand new fee of insurance rates and you will taxation, and need in which to stay your house on lifetime of the loan. Reverse mortgage loans supply an age element 62+, which regulations it while the a feasible choice for of many.

There’s a lot to adopt when looking at conventional and you may choice an effective way to accessibility your house collateral. The following publication helps you navigate for every alternative even more.

Finding a choice? Enter the Home Guarantee Investment

A newer replacement for house collateral fund is family security assets. The many benefits of a property equity financing, such as for instance Hometap also provides , or a shared fast payday loans online enjoy contract, are numerous. These buyers make you near-immediate access towards the collateral you’ve made in your home within the exchange to have a share of their future worthy of. After the fresh investment’s energetic months (and this hinges on the organization), your settle the brand new money by buying it with deals, refinancing, otherwise attempting to sell your residence.

Having Hometap, including an easy and seamless app processes and you can novel qualification standards that’s will a lot more inclusive than that of lenders, you should have some point off get in touch with on resource feel. Probably the main variation is the fact instead of these types of more conventional avenues, there are no monthly payments otherwise notice to consider to your best of your own mortgage payments, to reach your financial requires reduced. Whenever you are seeking to alternative getting collateral from the household, dealing with property security individual could be well worth examining.

Is an effective Hometap Financial support just the right home security mortgage alternative for both you and your possessions? Capture our four-time test to find out.

I carry out all of our best to ensure that everything when you look at the this information is due to the fact particular as possible as of the brand new day it is published, but anything transform quickly both. Hometap cannot recommend or monitor any connected other sites. Individual affairs differ, therefore speak to your very own fund, tax or lawyer to see which is practical for your requirements.