Property try an extremely large and usually immediately following inside the a beneficial life-big date decision that involves a giant amount of cash. Thus,if you are going to get your family, it’s always best that you sign up for a mortgage.

Behind closed doors, a number of young adults desire getting property however, find it hard to turn their dream into the facts because their personal info do not let them to take action. To order property seems to be one of the challenging jobs while the most money is needed. Here Mortgage brokers gamble a vital role for the riding your compliment of the path of accomplishing your ultimate goal.

To begin with, you must analyse your revenue and you can costs and then arrive at that loan figure, whose EMI you can afford to blow four weeks. You could discuss toward rate of interest or any other terms of financing lender, whenever you are the dated customer & hold a good credit history.

Getting a home loan you need to get mortgage having picked financial. The lending company will go through your mortgage software and determine on your residence financing qualification considering some issues together with your earnings, ages, credit rating, monetary background, assets location, character regarding a job, an such like. and you can tell you the loan matter, interest rate and loan tenure that you are entitled to. Whether your bank was satisfied up coming merely you can buy the fresh new wanted loan amount.

Reasons to Go for Financial out-of Private Field Banks

- Individual Industry Financial institutions give faithful and you can better-trained matchmaking manager to carry out all difficulties and you will issues

- They give you home provider on the consumers

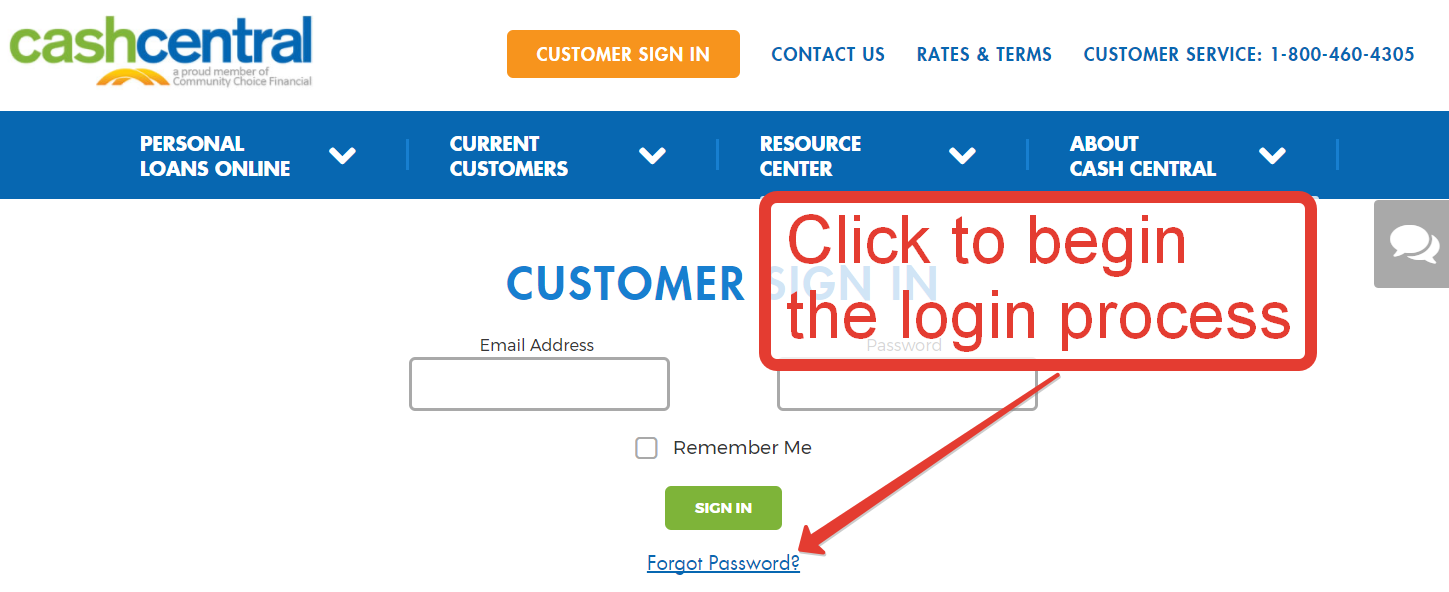

- Most of the non-public sector banks give on the internet system to make use of to have home loan

- You can get quick and troubles-totally free procedure

Issues to know about Lenders

Mortgage Qualification: Financial evaluate your residence loan eligibility using individuals parameters for example your age, income, credit rating, CIBIL Score, a career reputation, financial record, possessions & obligations, loan amount and you may period of mortgage.

Style of Interest rate: Regardless if you are making an application for a fixed otherwise floating rate of notice. Inside repaired interest you pay repaired EMIs during the entire mortgage period while in drifting rates, interest change also improvement in sector requirements. And therefore, the EMI helps to keep altering.

Fine print: Small print we.elizabeth. financing contract are going to be undergone meticulously before you sign. Identify all the small print in more detail ahead. In the eventuality of people inquire, ideal request the financial institution.

File Number: You should fill in certain records along with your financial software which can be Title Evidence, target research, decades proof, earnings evidence, They Returns, financial statements, content away from title off property documents, etc. You need to know all of these file number far ahead of time and you can have them in a position before you apply to possess financial.

Throughout the EMI

EMI stands for Equated Monthly Instalment that you ought to shell out every month towards lender against mortgage availed of it. It will decrease your loan liability toward month-to-month base. EMI integrate Principal and you will Accrued Appeal inside. Computation regarding EMI depends abreast of the pricipal, interest and the mortgage period.

- High the primary, highest the fresh EMI

- Big the borrowed funds period, lessen the EMI

- Greater the rate of interest towards the financial, large the latest EMI

Large percentage of EMI will go for the make payment on interest and you may a part of the EMI goes to your dominating within the the original years.

It has been viewed you to loan providers have a tendency to make an effort to highly recommend your to help you pick an extended period home loan since it often getting not harmful to these to get their cash return as you can merely spend a reduced EMI. However would be to pick the fresh period which is appropriate to you.

Major reasons out of Home loan Getting rejected

Devoid of good credit is one of the essential reasons out-of financial getting rejected. Youre suggested so you’re able to basic look at your credit score before you apply to own home financing. When you yourself have a decreased credit history, there are also of several opportunity that the loan application will get rejected.

If you possess a dismal credit score then you definitely is to earliest concentrate on enhancing your credit rating to at the least a lot more than 750 draw right after which any time you make an application for home loan.

However if, you are modifying your task seem to and there’s zero job stability to you previously then financial will be afraid in granting your residence application for the loan. You need to understand here whenever there’s absolutely no balance inside your job then your lender can get consider it as your unstable behaviour.

Occupations Stability is really number 1 matter into the lenders’ point out of consider. Some of the loan providers in addition to set conditions of getting minimum a position away from continuous 36 months on your installment loans Richmond IN existing team.

It can be a situation your mortgage software have already been denied before on account of some of the explanations up coming here are many odds the bank to which youre position your house application for the loan, together with rejects your situation.

For those who have wanted financing to own highest period which is maybe not appropriate for your loan eligibility then there are chances one the application may get denied.

The following the new stepwise process to become observed so you’re able to manage home loan getting rejected securely and get your residence loan acknowledged in the course of time from the financial:

- Step 1: Learn the Need Accountable for Getting rejected

- 2: Work effectively with the Cause away from Rejection