Relevant Articles

A property collateral line of credit are a moment home loan notice according to collateral of your property. Talking about unavailable through the Government Property Government, you could receive good HELOC when you have a keen FHA financing payday loans Gaylordsville and create sufficient guarantee in the house so you can qualify. An effective HELOC was a good rotating personal line of credit to own residents in order to availableness as much as the credit line restrict as needed.

FHA Finance

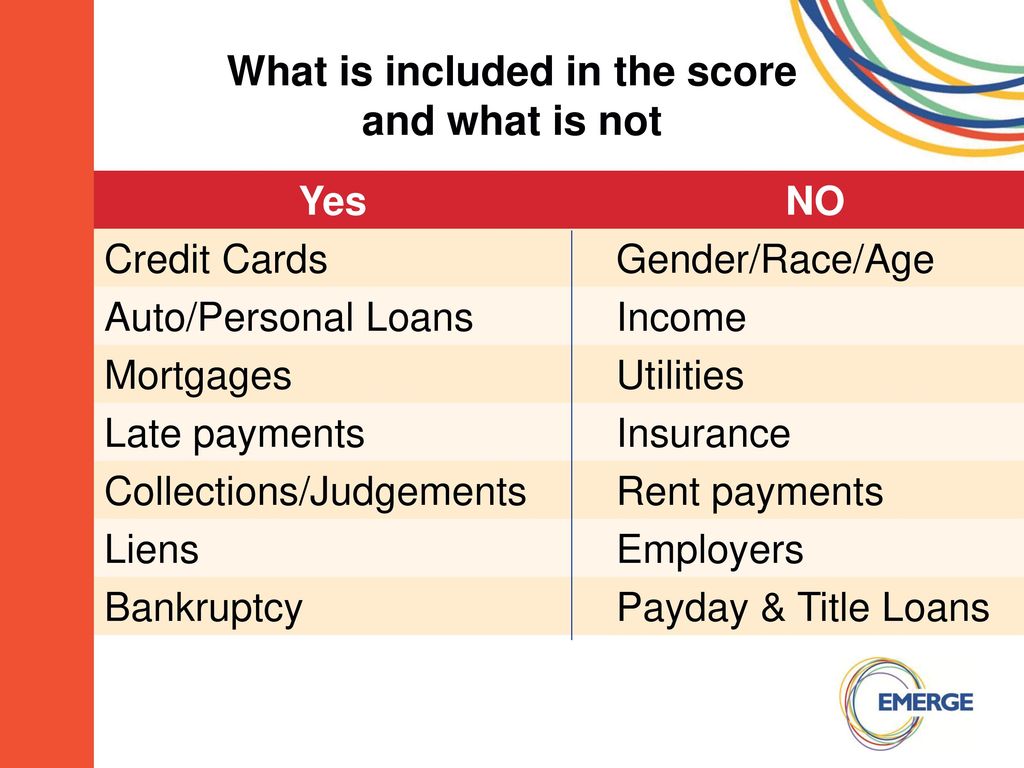

An FHA mortgage is an excellent mortgage option for first-big date homeowners who don’t has expert borrowing, a giant deposit otherwise finance having closing costs. The fresh U.S. Company away from Casing and you can Urban Development means FHA finance. Qualified homebuyers need to lay an advance payment of only step three.5 to help you 10% on household. People who have credit scores more 580 meet the criteria towards step three.5 % deposit. Borrowers that have credit ratings ranging from five hundred and you will 580 need certainly to lay out 10%.

Even with a 10 percent downpayment, yet not, there isn’t enough security yourself to fulfill qualification requirements for many HELOC loan providers.

Guarantee on your Property

Security is the value of your property shorter any money you owe on it. Like, a frequent the newest FHA loan for a property costing $250,one hundred thousand with step 3.5 % down mode the first-condition financing the primary financing are $241,250. The original collateral is the down payment of $8,750.

In case the downpayment was indeed 10 %, your security might be $twenty five,one hundred thousand. The secret matter to own HELOC consideration is at the least 20% equity, but generally lenders want nearer to forty % or more inside the collateral. It will be easy that home’s like, whenever appraised once again, along with your dominating money into financing move you to higher security account at some point.

Applying for the brand new HELOC

Making an application for a great HELOC function being qualified to have another mortgage mention that have a card loan application. Store rates and you may terms in the banking institutions and you will borrowing from the bank unions. If you only had the FHA financing processes and signed escrow, you will have all data files you would like. Data were 2 years away from tax returns, proof money and you may verification away from expenses. Your own lender need your own latest pay stubs and you may reasons of every alterations in your situation, or no can be found. The financial institution usually acquisition a credit file and you can an appraisal on the the property; the fresh assessment was an aside-of-wallet ask you for pay for.

Bank Considerations

Loan providers was unwilling to instantly agree HELOCs even though you will find guarantee. Might consider the large possible payment of your own HELOC, factoring they into the full personal debt-to-earnings proportion. The fresh DTI discusses monthly debt payments than the month-to-month earnings; loan providers expect the DTI getting 45 percent otherwise faster that have at least credit rating from 660, but they prefer high credit scores.

Though there is lots off security and you can a good DTI, lenders was unwilling to instantly approve HELOCs, specifically for new residents who don’t have an extended history out of repaying a mortgage or using it off. They are hesitant since the HELOCs are next-condition financing on the very first-status home loan.

For the a foreclosures or personal bankruptcy situation, second-status loans get money which have remaining financing, or no, after the very first status try paid off. To increase your chance of getting an extra-status mortgage, focus on your existing bank, who does hold loan cards toward both the earliest and you will next positions, getting additional control more possible foreclosure profits.

- U.S. Service of Housing and you can Urban Creativity: Let FHA Financing Make it easier to

- Bankrate: The required steps to Obtain At home Collateral

Kimberlee Leonard lived-in the fresh San francisco if you find yourself going to school at the University away from Bay area. Ahead of is a full-date creator, she worked for biggest creditors such Wells Fargo and State Farm. She has set up posts to have names such as for instance Trupanion, Alive Your Aloha, Neil Patel and you will Where you can find Wade. She currently resides in their house county from Their state with her productive man and you may lazy puppy.