Do you know the Criteria to have USDA property?

When you find yourself looking for a house and looking having affordable selection. You really have heard about USDA-qualified virginia homes. USDA qualification refers to homes which might be based in rural areas and you will meet certain conditions.

Here, we are going to classification what an USDA eligible property ends up. Where to find USDA homes for sale in your area? And you can which are the USDA financial requirements and other essential information about these financing applications?

Could you be wondering in the event that property near you qualifies given that USDA eligible?

Very first, the home have to be situated in a location believed rural of the this new USDA. The house should be situated in a place designated because of the USDA as rural. This is why it needs to be outside of area limitations or in this look for parts determined by the business.

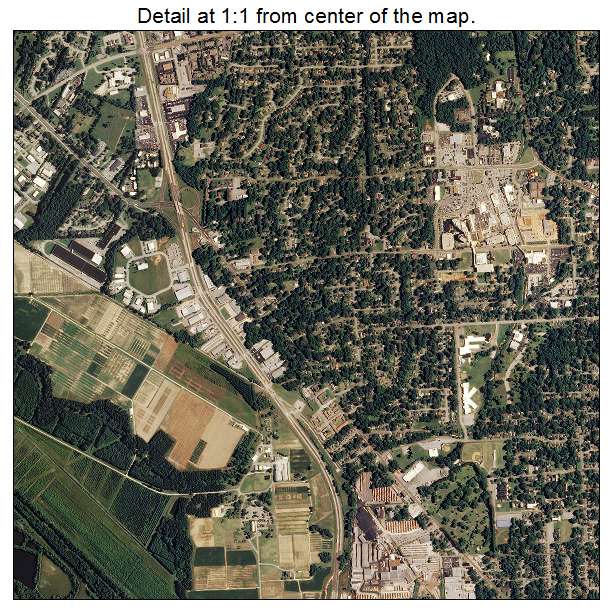

How to determine if your need place qualifies as the rural is to look at the USDA’s possessions qualification chart. The latest USDA home loan map you to definitely verifies new address off good home is situated in a good eligible area.

Just what status does a property should be set for a great USDA-eligible Home loan?

Basic, let us consider exactly what position requirements for your home have to satisfy getting considered entitled to a great USDA loan. Not only is it situated in an eligible area, the residence’s updates have to meet certain standards to possess an excellent USDA financing. According https://paydayloancolorado.net/dove-valley/ to USDA, most of the land should be for the great condition and you will appraised towards the purchase price or even more.

At the same time, the home also needs to meet particular standards from status; USDA Lenders need no significant products located during a review. Nonetheless they declare that most of the functions need to have sufficient supply courses and you can utilities particularly liquid, sewer, and you can energy.

Do you know the conditions getting USDA qualified possessions?

It’s important to think of, too, one even though you see a USDA Qualified domestic that fits the requirements needed seriously to discovered so it loan kind of. There’s no guarantee that the loan software are still approved on account of income limits or loan amount. USDA lenders tend to still check applicants’ credit rating, debt-to-income ratios, and other areas of the new creditworthiness from a prospective domestic customer.

USDA mortgage is intended on acquisition of a primary quarters. Because of this the house youre by using the loan to buy have to be their long lasting household, and never an extra home otherwise investment property Therefore it is usually far better talk to an expert ahead of committing too much money towards the process of to purchase a qualified house close by!

USDA fund want efforts when looking for eligible house; although not, they give good chance for those who qualify because they give low-rates of interest and you may costs in contrast to traditional mortgages leading them to well worthwhile considering when buying property close by!

Become entitled to a great USDA mortgage, your earnings ought not to meet or exceed certain constraints put from the USDA. The cash restrictions are different because of the venue and you can home size. Overall, the funds limit will be based upon this new area’s average income and you can just how many anyone residing in the family.

To choose if you find yourself qualified predicated on monthly earnings, you can examine new USDA’s money qualifications calculator on their website. Make an effort to get into your location together with level of members of your family, and the calculator will tell you for many who meet up with the earnings requirements to possess a beneficial USDA home loan.

Keep in mind that the fresh USDA mortgage system is made to assist low so you’re able to reasonable-earnings anyone and family members for the outlying section reach homeownership. In case your earnings is just too large, you may not be eligible for good USDA financial, and also you s eg USDA otherwise a conventional mortgage.

One of the tall great things about this program is the fact it will not mandate a downpayment. And USDA loan program don’t have personal financial insurance in their financial program reducing the monthly premiums for potential buyers.

People can also enjoy 100% financial support, beginning doorways for many who could have faced demands enhancing the 1st fund for their dream house. Overall, the fresh USDA’s no down-payment plan is actually an invaluable money to possess those individuals finding affordable houses alternatives from the outlying components of the us.

When the time comes order your domestic, just remember that , there are most conditions associated with the obtaining that loan using RHS (Outlying Housing Services), for example earnings limitations and you will credit conditions-thus definitely discuss this then with your lender in advance of and come up with any decisions regarding to shop for an eligible home. And lastly, make sure you remember regarding the other costs associated with buying a home, like settlement costs, check costs, label insurance costs, and a lot more!

We hope this blog was helpful in bringing insight into USDA-eligible virginia homes close by! With your tips and you will resources, hopefully looking your perfect domestic could well be a breeze!